There has always been hype in the media about the “Sydney Property Market”, being the leading property market in the country and the last word in property investment for gains and returns.

This narrative has influenced the “Headline Readers” to stick with what little they know and buy where they already live, thus creating the self-fulfilling prophecy of the ever-increasing Sydney Property prices.

Throw in 30 years of downward trending interest rates and more liberal lending policy and we have what has been described as the “Boomer Utopia” where young families and lower income earners can no longer afford to call Sydney home especially if they want to live in a house.

The thoughts that may be crossing many Sydneysiders’ minds is – I have to buy in Sydney as it’s the best market in the country but I can’t afford to! – so what do we do? – where can we buy? – where can we afford?

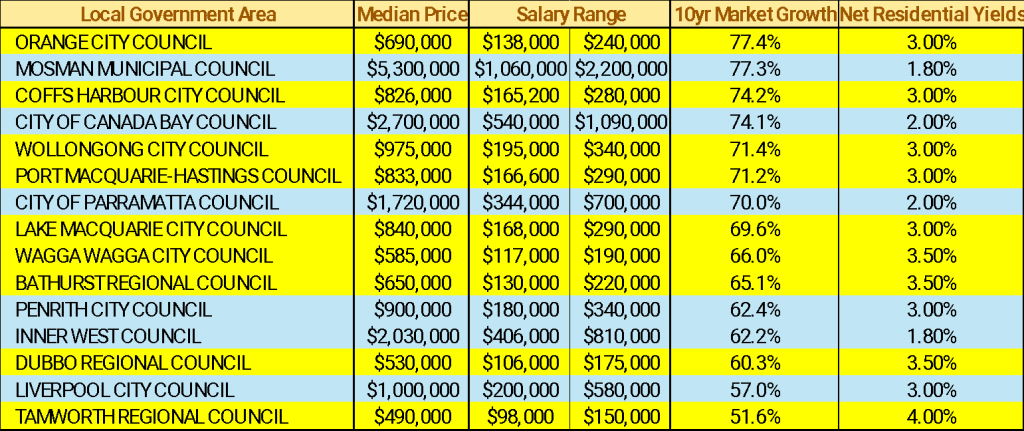

I’ve run some numbers on this to see how different markets in NSW compare in performance and completed more calculations on how much gross household income you need to buy a median priced house in these markets – the answers are surprising – if not astonishing.

Explaining the Table

The salary ranges are based on making some assumptions around having no other liabilities on your income other than income tax and contributing (an almost unrealistic best case scenario) 50% of your take home pay to mortgage repayments resulting it the lower salary figures, to contributing 30% (the more realistic scenario) to mortgage repayments which requires the higher salary level.

So Taking Dubbo as an example – being able to contribute 50% of your after tax pay to mortgage repayments you need to earn $106,000 pa, if you will be contributing 30% of your after tax pay you will need to earn $175,000 gross pa.

These estimates are simplified and don’t take into account allowances of the individual, so your actual numbers may vary, but if your salary falls in the ranges, it would be worth getting assessed for a loan if you’re keen on purchasing property.

The point of this exercise was to identify the best performing markets over the past decade, then identify the most affordable markets giving the “Best bang for your buck”. Whilst this review does not cover every LGA in NSW it gives a good spread across the state comparing metro markets to regional markets.

If you have found yourself priced out of your local market and wondering how you can ever afford to buy property without missing out on the gains, then taking a serious look at some of the regional markets may be the solution to your problems. Consulting with a business advisory service or a financial advisor Sydney can also provide valuable insights into how to navigate these markets strategically.

Reviewing historical data is one thing, and with hindsight everyone has 20/20 vision. How to pick which areas will have the top capital growth rates in the next 10 years, becomes a little difficult.

For more information on property markets and property purchasing head over to the web page where you will find more blogs that help benefit you.