Mistakes to Avoid When Buying in Regional Locations

Purchasing a home in regional areas seems like an attractive prospect. However, the perception of lower prices can often mask hidden risks and challenges. Without the right guidance, buyers may find themselves facing unexpected hurdles and potential financial setbacks.

Our own Matt Ward was a guest on the "Your First Home Buyer Guide Australia" Podcast and shared his insights on the Mistakes to Avoid When Buying in Regional Locations. (Duration: 52mins)

Matt Ward & Street Secrets podcast | YouTube

The episode focuses on Matthew's expertise regarding Central NSW property fundamentals, local buyer behaviour, and the importance of "street-level knowledge" over pure data.

Platform | LinkAudio Podcast | Listen Here

YouTube Video | Watch Here

RBA Move, Real Impact: What a 0.25% Shift Means for a Typical Orange Mortgage

If you’re entering the property market for the first time, the regional city of Bathurst in NSW may not be your initial pick, but it should be. Known ...

Why Bathurst’s Market Pulse Matters for First-Time Investors

If you’re entering the property market for the first time, the regional city of Bathurst in NSW may not be your initial pick, but it should be. Known ...

Your Go-To Guide To Government Grants and Incentives

Buying a first home can feel like a steep climb, especially in NSW, where housing prices in urban areas are steeper than ever. These rising prices, along with ...

The Rise of The ‘Bank Of Mum & Dad’ in Property Investment

Current market trends, such as rising property prices and the high cost of living, have made it increasingly difficult for first-time buyers to enter the housing market, especially ...

The Bright Future of Regional Australia’s Property Market

Many Australians, young and old, are trading city congestion for the open skies of regional areas. Not only are they drawn by the lifestyle, but also by the ...

How to Build a Strong Investment Property Portfolio

Whether you're in the bustling city of Sydney or looking at regional properties in New South Wales (NSW), building a strong property portfolio is not simply about collecting ...

The Importance of Due Diligence in Property Investment

You’re excited because you've just found what seems to be the perfect investment property. It's in a great location, has an appealing design and has all-around promising potential. ...

Leveraging Negative Gearing For Maximised Tax Benefits

You've found an investment property that fits your long-term goals, you've crunched the numbers, and you've spoken to your broker. It’s clear that the property will not turn ...

Understanding Property Valuation And Its Importance

Property valuation is more than just pricing a property based on its size and amenities. Rather, an expert property appraisal involves a thorough assessment of contextual factors. Whether ...

Maximising Your Rental Income Through Property Management

Rental property management is crucial for getting ahead of the competition. Through proactive property maintenance and careful tenant selection, you can ensure that your residential property investment yields ...

Achieving Property Investment Goals: WPG First-Timer Success Story

Helping everyday Australians make confident property decisions is a big part of what we do here at WPG Advisory. This is especially important for those who are entering ...

Regional Relocation: Your Step-By-Step Guide To A “Tree Change”

Have you been looking into regional relocation because you're seeking a lifestyle change? A “tree change” might be an ideal solution. A tree change gives you a closer ...

Informed Confidence and the Psychology of Investing

There are plenty of opportunities to be found for wealth creation in the Australian property market for savvy investors. However, making substantial financial decisions can often evoke a ...

Securing Your Financial Future With Property Investments

The Australian real estate market is continuing to rise in value, making it a hotbed of wealth accumulation for seasoned investors and first-time buyers alike. Therefore, if you ...

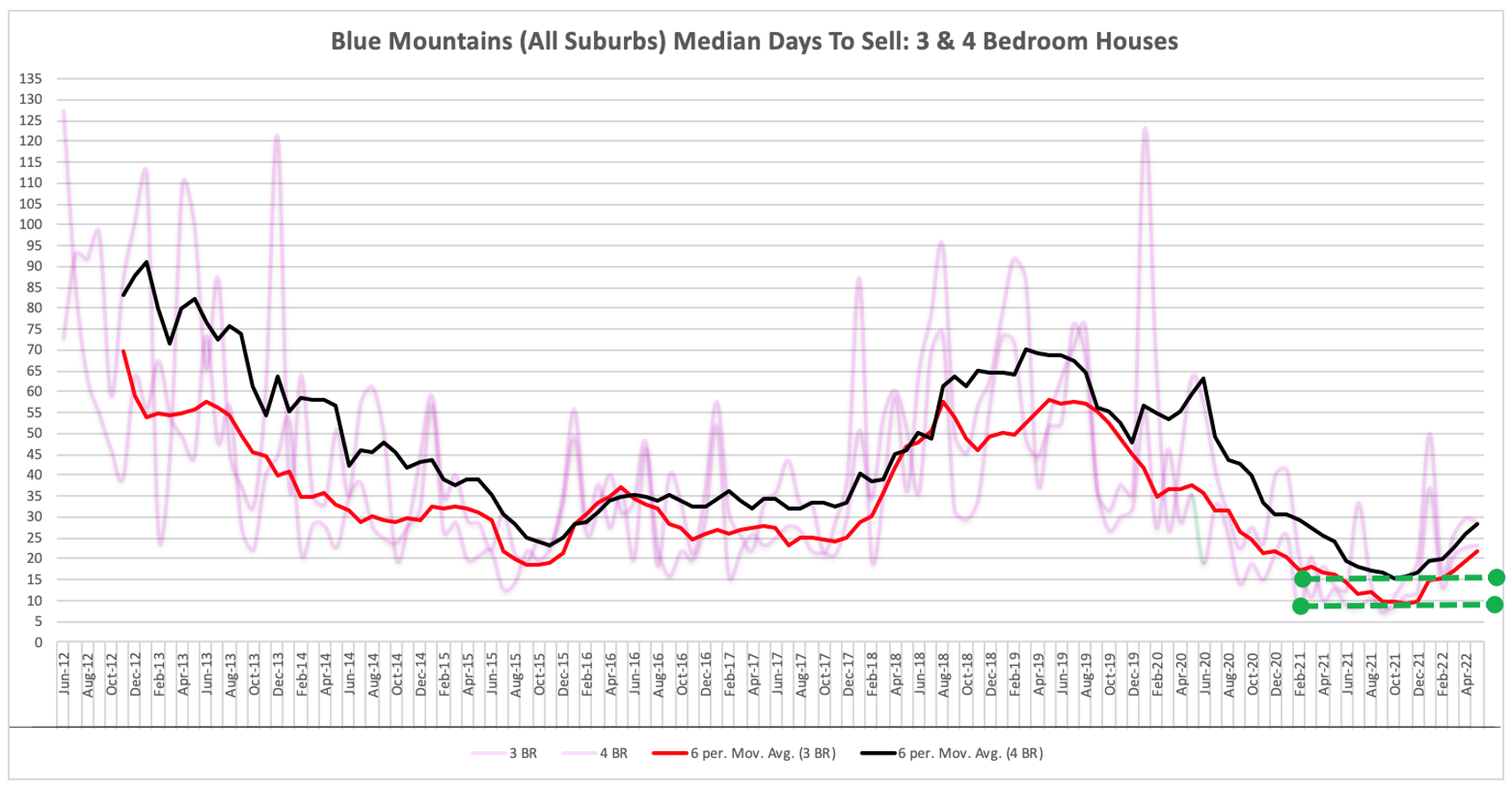

Blue Mountains – Median Days To Sell

The chart details the median days to sell for 3 & 4 bedroom houses. The underlying data lines have been faded out to reveal the trends by focusing ...

Furnished or Unfurnished Rentals?

A primary question for landlords/investors should be which is the better option furnished or unfurnished? There are many pros and cons to both unfurnished and furnished properties. There ...

Navigating The Regional Property Market With Finesse

There are plenty of investment opportunities in the regional property market. Let’s take a look at some of the regional property trends that emerged in the past few ...

Understanding The Orange Rental Market Opportunities

There is plenty of opportunity in the Orange rental market, where rental yields are getting stronger quarter on quarter and tenant demand is on the rise. This area ...

The Power of a Buyer’s Agent

The real estate market is notoriously complex, with the property buying process being time-consuming and intimidating. Overcoming these challenges is doable when you have a buyer's agent to ...

Finding Your Ideal Investment Property

One of the most dependable ways to grow your wealth is through real estate investing. However, finding the right property to invest in requires a thorough property search ...

Demystifying The Property Investment Process

As a prospective first-time investor in the property sector, you're no doubt already feeling a little overwhelmed by the overabundance of information, administrative requirements and property investment jargon. ...

Building Wealth Through Regional Property

For many investors, property remains a cornerstone of long-term wealth creation. However, while high-value urban areas often dominate the property market, substantial opportunities are emerging in the regional ...

Tree Change: Your Path To A Better Life

The tree change movement has gained momentum in recent years as more and more people seek out a better quality of life in rural areas. Among the many ...