When considering renting out your property, there are many different aspects that will have a direct impact on you’re the income your property can generate.

Long term rentals have always been a popular way to gain income from property, but is this still the best way forward? or is Furnished/Serviced and Bnb rentals now a better option?

To compare this further we have conducted a case study on two different properties.

Case study one is a three-bedroom double brick dwelling located centrally in Orange with a recent purchase price of $700,000.

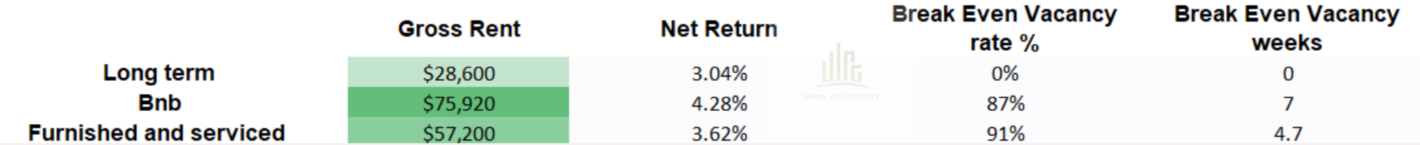

This property would rent for $550 a week ($28,600 gross pa) which shows a Net yield of 3.07%, assuming property management via a real estate agent with the usual holding costs.

The major pros of long-term rentals is the steady cash flow and the generally hands off management, and the holding costs and outgoings are as low as possible, however the some downsides can be that the weekly rent cannot easily be changed during the lease term, you are stuck longer term with the tenant for better or worse, and tenant rights can leave you at the mercy of tribunals if things turn bad.

Considering other options may be the way to go –operating a Bnb from the property allows you to be more flexible with your rental pricing, which can result in charging higher rents at more popular times like weekends and holidays.

Setting up the subject property as a BNB could set you back around $30,000, and allow you to generate about $75,920 gross pa which this example shows a Net return of 4.54%, this assumes at least 3 nights a week occupancy for 52 weeks a year. After outgoings and holding costs such as cleaning, rates, electricity, gas, water, insurance, repair, maintenance, and management fees (around 25% + GST pa) have been considered.

The BNB will require an occupancy rate of 85% or higher allowing for only 8 weeks of vacancies per annum to make it a stronger investment option then long term rental. The upside is if you can rent the property more than 3 nights/ week, then you would be well in front then the long term rental model.

Another option for you to consider is the Furnished and serviced rental market. Once again you will need to furnish it with a similar set up cost to a BNB, however this style of renting the tenant stays between say 3 -12 weeks at a time, and the rent for this property would be about $1,100 per week ($57,200 gross per annum).

Similar outgoings will apply as a BNB although management fees will be about 11% + GST and cleaning will be reduced. In this scenario the subject property Nets about 3.62% per annum.

To justify renting this property out as a furnished and serviced rental it would need an occupancy rate of 91% per annum or better allowing for only 4.5 weeks of vacancies per annum to make it a stronger investment option, over long-term rentals. This also assumes occupancy 7 days per week.

This table below summarises the vital stats for each model in case study one

For the second Case study we have chosen a two-bedroom brick veneer villa in a small complex located centrally in Orange with a recent purchase price of $450,000.

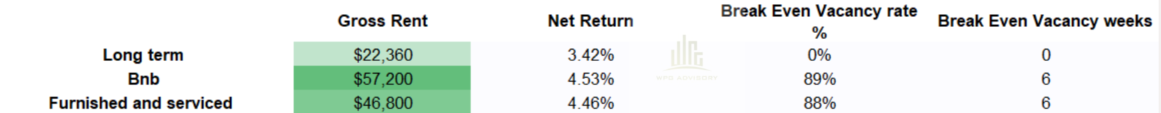

The subject property shows an annual Net return of 3.16% as a long-term rental.

As a Bnb this subject property having only two bedrooms would cost about $25,000 to furnish and generate an annual gross rent of $57,200 and an annual net return of 4.85% assuming occupancy at least 3 nights a week for 52 weeks pa. The subject property would need an occupancy rate of 89% or better allowing for only 6 weeks of vacancies per annum to make it a better investment option than long term renting.

As furnished serviced offering the subject property furnishing costs would be similar, generating a weekly rent of $900 ($46,800pa gross) and an annual net return of 4.48%. This property allows for an 88% occupancy rate per annum allowing for up to 6 weeks vacant to make this model a stronger investment option over long term renting.

This table summarises the key information for case study two.

The key takeaway from this analysis is that BNB and serviced rentals can offer significant income gains over long term rentals, even with the additional associated costs and management requirement.

The critical statistic is the vacancy factor, if your vacancies are higher or your total nights per week are dropping then you are probably taking on a lot of risk and costs for the little additional income.

Vacancy rates can be influenced heavily by, style and location of property, pricing, strength of the local BNB market and proactive and effective management. Some of these key influences can be fixed but choosing the right property to start with is a critical to the long term of your investment success.

BNB rental offers the flexibility in being able to use the property yourself if you wish too, which you cant do with a long term leases, so it really depends on how serious of an investor you are. There are always variations and individual circumstances, and different property’s will alter the above findings for your situation, but indicatively, the above data should have you thinking about what alternatives maybe available for your current or future investments.